ARCPLC Decision Aid and Write-Up

2021 Seed Cotton (SC) ARC/PLC Quick Read and Decision Aid

Don Shurley

Cotton Economist-Retired

Department of Agricultural and Applied Economics, University of Georgia

Producers may elect and must enroll in ARC or PLC, by crop by farm, for the 2021 crop year by March 15. If no election is made, the election previously made for 2019-2020 will remain for 2021.

PLC is a payment based on a market price trigger—if the market price is less than the Effective Reference Price. ARC is revenue based. Payment is received if Actual Revenue is less than the Revenue Guarantee which is based on price and county yield history.

2021 Seed Cotton (SC) ARC/PLC Quick Read and Decision Aid

Don Shurley

Cotton Economist-Retired

Department of Agricultural and Applied Economics, University of Georgia

Producers may elect and must enroll in ARC or PLC, by crop by farm, for the 2021 crop year by March 15. If no election is made, the election previously made for 2019-2020 will remain for 2021.

PLC is a payment based on a market price trigger—if the market price is less than the Effective Reference Price. ARC is revenue based. Payment is received if Actual Revenue is less than the Revenue Guarantee which is based on price and county yield history.

2020 Seed Cotton PLC

The PLC Payment Rate for the 2020 crop is currently projected at 2.06 cents per lb. This will change—the 2020 crop marketing year for seed cotton does not end until July 31.

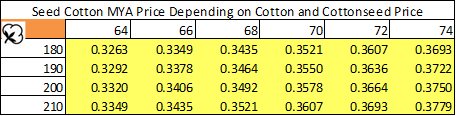

The MYA price for seed cotton is a weighted average price for cotton and cottonseed. The average cotton price for the 2020 marketing year is currently projected to be 68 cents per lb. The cottonseed price is currently projected at $190 per ton (9.5 cents per lb). The seed cotton price is a weighted average based on production:

SC MYA Price = $0.68 x .4297 + $0.095 x .5703 = $0.3464

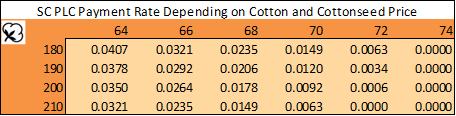

SC PLC Rate = $0.367 Effective Reference Price - $0.3464 = $0.0206

2021 PLC

The PLC payment for a crop for a farm depends on the farm’s PLC Payment Yield. The Payment Rate is the same for everybody. But, the $/acre will vary depending on the Payment Yield. So, how PLC and ARC compare will vary.

New crop 2021 Dec cotton futures are currently over 80 cents. The US MYA Price for cotton runs at least 3 to 5 cents below futures. The price of cottonseed has also increased—being pulled up by soybeans.

It appears that prices for 2021 production may average as high or higher than for 2020 crop. As you can see, at 70 cents cotton or higher and/or $200 cottonseed or higher, the seed cotton PLC approaches zero.

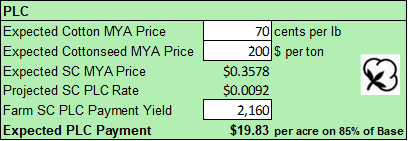

It’s seems safe to use 2020 as a starting point and play “what if” from there. If, for example, we use 70-cent cotton and $200/ton cottonseed, the seed cotton PLC Rate would $0.0092 (.92 cents). Assuming a seed cotton Payment Yield of 2,160 lbs (the equivalent of 900-lb cotton), the PLC Payment would be $19.83 per acre received on 85% of seed cotton base acres.

If we were to increase prices to 72 and 200, the PLC is then almost zero-- $1.27 per acre.

Comparing ARC and PLC

PLC is determined in-part by your farms Payment Yield based on your history. ARC, on the other hand, is determined in-part by county yields, not yours. How ARC and PLC compare will depend at least somewhat on how these yields compare.

The 2021 ARC Benchmark Yield and Benchmark Revenue are available from USDA-FSA by state, by county, by crop and can be found in spreadsheet form at the following website:

https://www.fsa.usda.gov/programs-and-services/arcplc_program/arcplc-program-data/index

Click on “Program Year Specific Data” then look under “Program Year 2021 Data” and click on “2021 ARC-County Benchmark Yields and Revenues”.

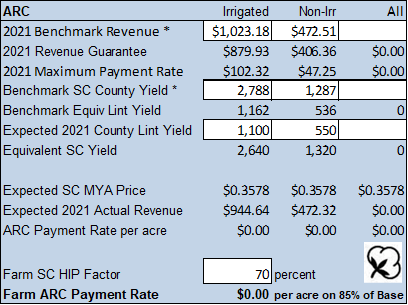

This is an example Georgia county with data entered from the website. This, and almost all counties with seed cotton base, are a “HIP county” meaning that yields will be shown for both irrigated and non-irrigated production. If in a HIP county and if the farm has a history of irrigating the crop, the farm will have a “HIP factor” assigned by FSA for that crop. Otherwise, there will be no HIP factor applicable. If the county is not a “HIP county”, the website will instead show a single ARC yield “All” and the farm will have no HIP factor.

In this example, the ARC historical irrigated seed cotton yield is 2,788 lbs or a lint yield of 1,162 lbs (seed cotton yield is 2.4 times lint yield). The historical non-irrigated seed cotton yield is 1,287 lbs or an equivalent lint yield of 536 lbs. The farm has a seed cotton HIP factor of 70% irrigated. For analysis, as an example, expected/typical lint yields for 2021 are 1,100 lbs for irrigated and 550 lbs for non-irrigated—seed cotton would then be 2.4 times this.

In this example, and using the same SC MYA Price as in PLC, Actual Revenue will be more than the Revenue Guarantee. No ARC Payment would be made.

This comparison of ARC and PLC is for illustration purposes only.

What Does It All Mean—How To Decide

All indications, at present, suggest that prices will be strong for the 2021 crop. But anything is possible. And, of course, county yield is also a large unknown.

Run the PLC on a likely range of prices from high to low and with your farms PLC Payment Yield. For each of these price scenarios, compare each to ARC at those same prices based on the county data. What scenarios favor PLC and how likely is that to happen? What scenarios favor ARC and how likely is that to happen?

It may be that if prices are high and yields good, neither would pay. If one program is clearly very likely going to give a zero payment, then maybe your choice, by default, is the other program. ARC and PLC are your choices for what I call the farm bill “safety net”. Which program do you feel gives you the most potential protection over a likely range of yields and prices?

If you have a farm where the PLC payment yield is not good, that may be reason to go with ARC on that farm.

There are also crop insurance considerations.

If a farm has seed cotton base and if that base is enrolled in PLC, the cotton acres planted on that farm are not eligible for STAX, but are eligible for SCO.

If a farm has seed cotton base and if that base is enrolled in ARC, the cotton acres planted on that farm are not eligible for STAX or SCO.

If a farm has seed cotton base and if that base is not enrolled in ARC/PLC, the cotton acres planted on that farm are eligible for either STAX or SCO.

So, the available ARC/PLC and crop insurance combinations on farms with seed cotton base are

-Go with PLC, no SCO

-Go with PLC + SCO

-Go with ARC, no STAX, no SCO

-No ARC and no PLC, go with either STAX or SCO

If a farm has no seed cotton base, that farm is not eligible for seed cotton ARC/PLC anyway. Go with your choice of STAX or SCO or neither.

If a farm has only a small base compared to the acres you would like to plant on that farm (and this could be more typical than we think due to previous Generic Base conversion decisions), then it may be worth not enrolling that base in ARC/PLC and going with STAX or taking PLC + SCO.

Because prices are high and if they remain so for the 2021 crop, the PLC could be small or even zero. For that reason, growers may be leaning toward ARC. Yields are uncertain and if county yields are down in 2021, ARC could pay whereas PLC may not. But if you go with ARC, the farm is not eligible for STAX or SCO. If the county yield is down, either STAX or SCO could pay. ARC could pay but you would have no SCO or STAX. PLC may not pay, but you would have SCO that might pay if county yield is down.